External Assessment of ESG

Shareholder and stakeholder demand to better understand corporate ESG initiatives has spawned a cottage industry of third-party organizations that publish rankings and ratings of companies on various environmental and social dimensions. Examples of rankings include:

Bloomberg Gender-Equality Index—Measures how companies “invest in women in the workplace, the supply chain, and in the communities in which they operate.”58

Corporate Responsibility Magazine Best Corporate Citizens—“Recognizes outstanding environmental, social and governance (ESG) transparency and performance among the 1,000 largest U.S. public companies.”59

Ethisphere Institute Most Ethical Companies—“Recognizes [companies] for setting the global standards of business integrity and corporate citizenship.”60

Fortune Best Workplaces for Diversity—Ranks companies that “create inclusive cultures for women and people of all genders, people of color, LGBTQ people, employees who are Boomers or older, and people who have disabilities.”61

Newsweek Green— Compiles “environmental performance assessments of the world’s largest publicly traded companies.”

Examples of ratings include:

FTSE Russell—“Allows investors to understand a company’s exposure to, and management of, ESG issues in multiple dimensions.”62

HIP Investor Ratings—“Derived from quantitative performance measures that demonstrate positive social, environmental and economic outcomes. Higher HIP Ratings also correlate with lower future risk and greater future return potential.”63

MSCI ESG—“Helps investors identify environmental, social and governance (ESG) risks and opportunities within their portfolio.”64

Sustainalytics—“Helps investors identify and understand financially material ESG risks at the security and portfolio level.”65

TruValue Labs—“Applies artificial intelligence to uncover opportunities and risks hidden in massive volumes of unstructured data, including real ESG behavior that has a material impact on company value.”66

These ranking and rating organizations employ diverse methodologies. Some rely on information publicly disclosed in financial statements or sustainability reports. Some rely on proprietary surveys distributed to the company or its employees. Others incorporate information derived from the media and event-related press releases. Multiple sources of information are sometimes combined to arrive at the assessment.

We examine the methodologies of selected firms and the predictability of their ratings in greater detail in the next chapter. However, several issues are worth noting here. The first one is the availability of information. Disclosure of ESG data is primarily voluntary, and more information is available about large corporations than small ones—because of their more extensive disclosure practices, larger investor relations departments, and greater media coverage. As such, an ESG rating firm must determine how to evaluate companies with different disclosure practices.

The second issue is how to assign weightings to ESG dimensions to generate an overall score. The concept of ESG includes a broad array of somewhat disparate environmental, social, and ethical issues. A ranking such as the Bloomberg Gender Equality Index makes an assessment of one ESG dimension and so weightings are less of an issue. Corporate Responsibility Magazine Best Corporate Citizens, on the other hand, takes a broad view and has to decide how to incorporate difficult-to-relate variables into a single outcome. This includes a determination of how to compute an overall score when an individual data element is not publicly available.

The third challenge is materiality. As discussed earlier in reference to SASB standards, various ESG dimensions have different relevance to different industries. How should the environmental stewardship of an energy or manufacturing company be compared to that of a technology or service company, given their different exposure to environmental challenges (carbon emissions, pollution, waste, and so on)? Should a company be compared only against its industry peers to determine which ones handle the matter better, or can companies in different industries be compared against each other?

Each ranking or rating firm makes choices on these questions. Because of this, the ratings assigned to companies vary considerably depending on the firm that assigns them. For example, MSCI gives Tesla Motors one of its highest ratings for environmental performance, but FTSE Russell gives Tesla a low score on environment because the FTSE Russell model does not take into account emissions from a company’s cars and only includes emissions from its factories. FTSE also penalizes Tesla in its social rankings because Tesla discloses little information about its practices, whereas MSCI assumes that if a company does not disclose information on a dimension that its performance is in line with industry averages. In another example, Sustainalytics gives ExxonMobil a relatively high ranking because it puts a 40 percent weight on social issues whereas MSCI ranks it lower because it puts a 17 percent weight on social issues.67

Still, on average, we see that large U.S. companies tend to receive high scores across providers. Whether this is due to greater availability of information about these firms, their willingness to engage with rating providers to supplement information, their embrace of and willingness to invest in stakeholder initiatives, or methodological biases by the rating firms is not known.

An analysis of 11 prominent rankings of companies based on environmental, climate-related, human rights, gender, diversity, and social responsibility factors shows that 68 percent of the Fortune 100 companies are recognized on at least one ESG list. The combined market value of these companies is $9.4 trillion, which comprises 84 percent of the market value of the entire Fortune 100. Cisco Systems appears on the most lists (eight); Microsoft on seven; and Bank of America, HP, Procter & Gamble, and Prudential Financial each appear on six lists. Even companies that are widely criticized by advocacy groups for their business practices are rated highly by third-party observers for ESG factors. For example, Chevron appears on the Dow Jones sustainability index and the Forbes list of best corporate citizens. Walmart is on Bloomberg’s gender equality Index. Comcast is on DiversityInc’s top 50 corporations for diversity. General Electric is named to Ethisphere Institute’s list of most ethical companies. (Perhaps unexpectedly, Berkshire Hathaway is not named to this list nor does it appear on any of the 11 lists reviewed. See Table 13.1.68)

Table 13.1 Fortune 100 Companies Appearing on the Most ESG Rankings

# Lists |

Companies |

Barron’s Most Sustainable |

Bloomberg Gender Equality |

CDP – Climate Change A List |

CDP – Water Management A List |

Corporate Knights Most Sustainable |

Corporate Responsibility |

DiversityInc |

Dow Jones Sustainability |

Ethisphere Most Ethical |

Forbes Best Corporate Citizens |

Fortune Best Workplace for Diversity |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

8 |

Cisco Systems |

x |

x |

x |

x |

x |

x |

x |

x |

|||

7 |

Microsoft |

x |

x |

x |

x |

x |

x |

x |

||||

6 |

Bank of America |

x |

x |

x |

x |

x |

x |

|||||

HP |

x |

x |

x |

x |

x |

x |

||||||

Procter & Gamble |

x |

x |

x |

x |

x |

x |

||||||

Prudential Financial |

x |

x |

x |

x |

x |

x |

||||||

5 |

AT&T |

x |

x |

x |

x |

x |

||||||

General Motors |

x |

x |

x |

x |

x |

|||||||

Johnson & Johnson |

x |

x |

x |

x |

x |

|||||||

4 |

3M |

x |

x |

x |

x |

|||||||

Allstate |

x |

x |

x |

x |

||||||||

Anthem |

x |

x |

x |

x |

||||||||

Best Buy |

x |

x |

x |

x |

||||||||

Citigroup |

x |

x |

x |

x |

||||||||

CVS Health |

x |

x |

x |

x |

||||||||

Goldman Sachs |

x |

x |

x |

x |

||||||||

Intel |

x |

x |

x |

x |

||||||||

MetLife |

x |

x |

x |

x |

||||||||

PepsiCo |

x |

x |

x |

x |

||||||||

UPS |

x |

x |

x |

x |

||||||||

# of Fortune 100 on List |

11 |

20 |

10 |

2 |

5 |

34 |

19 |

29 |

13 |

38 |

10 |

|

Based on rankings published between 2017 and 2019.

Source: Loosey-Goosey Governance (2019).

Research generally shows a modest relation between sustainability scores and firm performance and risk. Lins, Servaes, and Tamayo (2017) studied the performance of companies with high CSR scores during the financial crisis. They found that firms with high CSR ratings from MSCI experienced higher returns, profitability, growth, and sales per employee than firms with low ratings. However, there were no significant associations between CSR rating and performance in the periods before or after the crisis.69 Deng, Kang, and Low (2013) studied the relation between CSR and firm value by examining stock price returns around acquisition announcements. They found modest evidence that firms with high CSR ratings exhibit higher announcement returns and higher long-term operating performance post-acquisition. Performance differences were largely the result of below-average performance by low-rated CSR firms; highly rated firms did not exhibit above-average performance.70 Ferrell, Liang, and Renneboog (2016) studied the relations between CSR, agency problems, and firm value. They found that firms with low agency problems have higher MSCI ratings. They also found a positive association between firms with both low agency problems and high MSCI ratings and firm value.71

Margolis, Elfenbein, and Walsh (2009) conducted a meta-analysis of the research on CSR and firm performance. Their sample included 251 studies between 1972 and 2007. They found a small, positive association between CSR and performance but also that the positive association declines throughout the measurement period (that is, the effects of CSR were stronger in earlier studies and less so in later studies). They concluded:

After thirty-five years of research, the preponderance of evidence indicates a mildly positive relationship between corporate social performance and corporate financial performance. The overall average effect … across all studies is statistically significant, but, on an absolute basis, it is small.72

Finally, Gerard (2018) conducted a literature review on the relation between ESG scores and stock and bond price performance. He found that high ESG scores are related to higher profitability and firm value. He also found that positive performance differentials observed in the 1990s decreased in the early 2000s and disappeared in the 2010s, suggesting that any financial benefit of ESG is priced into securities markets.73

In general, research on ESG suffers from a problem of causality. Does a commitment to environmental or social goals make a company more profitable, or are more profitable companies able to spend more on these activities?

Despite pressure on companies to engage in ESG-related activities and corporate efforts to disclose their commitment to these initiatives, our ability to assess ESG quality remains limited. Inconsistent metrics, voluntary disclosure, and lack of comparability across firms account for much of the problem. Furthermore, it is not clear that the metrics that third-party firms develop to measure companies on ESG dimensions are accurate or reliable. (We turn to this question in the next chapter.)

As such, requiring all companies to incorporate a stakeholder orientation into their corporate planning—beyond the extent to which they already do so—would likely have unintended consequences with the potential to harm shareholders, employees, and outside stakeholders alike. Governance systems today—with an emphasis on shareholder returns, accountability of management to a board of directors, clearly defined performance metrics, and a capital market that disciplines companies for poor performance—might have their shortcomings, but the objective nature of stock price and operating returns are effective gauges for measuring performance and risk.

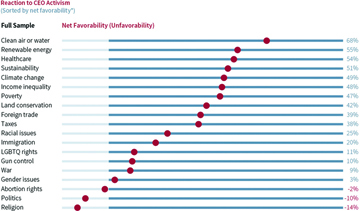

One solution (and one which many companies currently embrace) is to include ESG factors as key performance indicators in the same manner as other qualitative or nonfinancial information is used today to measure performance and award compensation—such as customer satisfaction, employee engagement, and product innovation (see the following sidebar). This gives discretion to companies and allows their shareholders and stakeholders to advocate for the adoption of policies most relevant and tailored to their situation and interests. It does not solve the problem of comparability of metrics across companies, particularly when a company chooses not to disclose proprietary information for competitive reasons, but it lessens the risk that management is held accountable to measures without a proven correlation to value, thereby weakening board oversight. (An interesting, related question is whether CEO activism—the practice of CEOs taking a personal stance on social, environmental, or political issues—is in the interest of a company. See the subsequent sidebar.)

The greatest challenge, and greatest opportunity, for ESG advocates is to incorporate a stakeholder orientation within a shareholder mandate, without disrupting the positive benefits that the current system accrues to shareholders and stakeholders alike.