- Blockchain: A Technical Perspective

- Blockchain for Enterprises

- Essential Maturity Imperatives for Enterprise Blockchain

- Token Revolution

- Understanding Digital Asset (Token) Fungibility: Opportunities and Challenges Related to Token Valuation and Blockchain Ecosystems

- Considerations for Meaningful and Sustainable Blockchain-Powered Business Networks

- Chapter Summary

- References

Token Revolution

Asset Tokenization: Essential to Powering the Next-Generation Digital “Instance” Economy

One of the core value propositions of a blockchain-powered network is the resulting co-creation elements, such as the digital transaction system and the value-driven ecosystem and marketplace. Asset tokenization is essential to powering the next-generation digital economy and paving the way for new business models that are built on the “instance economy.” To explore this topic, let us begin with some background.

Earlier, we discussed the challenges of the permissionless world, which does not adhere to any conventions and forges ahead with many innovations that are bound to disrupt many industries. Those changes may be advanced either through new business designs (e.g., initial coin offerings [ICOs]) or by conventional industries attempting to adopt the technology to either transform the industry or beat or keep up with disruption.

This combination of technology-driven platforms and the use cases that depend on them rely on the manifestation of value. Digitization—whether it is systemically generated in the form of a transaction utility coin or a layer-two token that relies on the underlying coin for its value—is nothing but a notation of an instrument that has a real or perceived value.

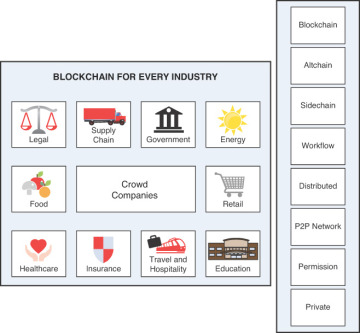

The genesis of blockchain as a permissionless system relied on a technology-based systemic governance composed of incentives and mechanisms of coordination. This systemic governance has its own set of challenges when it is used in enterprise business networks that attempt to use the tenets of blockchain technology. In the enterprise world, which is regulated and relies on permissioned blockchain models, the checks-and-balances system is complicated by transactions between competing entities that use regulated data and have a fiduciary responsibility. Such permissioned models cannot account for the tangible or systemically generated incentives (crypto-assets) or have network-wide mechanisms of coordination due to privacy and confidentiality issues. Figure 3.7 provides a view of the various types of blockchain and industry use cases.

Figure 3.7 Types of blockchain and industry use cases.

Introduction to Tokenization: Understanding the Token Revolution

Blockchain technology lays the foundation for a trusted digital transactional network that, as a disintermediated platform, fuels the growth of marketplaces and secondary markets due to new synergies and co-creation that come from new digital interactions and value-exchange mechanisms. Although blockchain itself provides the technology constructs to facilitate exchange, ownership, and trust in the network, it is in the digitization of value elements where asset tokenization is essential. Let us take a closer look.

Digitization is the first step in many enterprise and permissionless blockchain projects. Tokenization is the process of converting the assets and rights or claim to an asset into a digital representation or a token in a blockchain network. Note that there is a difference between an (crypto) asset or currency and a tokenized asset.

A (crypto) asset or currency is a medium of exchange or a protocol-driven exchange mechanism that embodies the same characteristics of a real-world currency, such as durability, limited supply, and recognition by a network, while being backed by a common belief system (like a fiat currency). A (crypto) asset or cryptocurrency also represents a by-product of trust systems (consensus) used as a vehicle to back the incentive economic model that rewards and fuels the trust system of a network, making it a trusted currency of the network.

Conversely, a token can be many things: a digital representation of a physical good, making it a digital twin of that good, or a layer-two protocol that is based on the (crypto) asset or currency and represents a unit of value. This distinction is important to understanding how the exchange vehicles, valuation models, and fungibility work across the various value networks that are emerging, which in turn poses challenges around technical interoperability and equitable swaps.

Asset tokenization presents interesting technology challenges:

Ensuring the integrity of physical assets, such as containers, gold bars, or cars

Ensuring that if a token will be the digital twin of a physical asset, the physical asset movement is seamlessly linked to the token movement in the digital network

Ensuring uniqueness and integrity of the token in and across the network

Ensuring the token’s ability to hold, transfer, and preserve the value of underlying assets that the token represents

Effectively managing the life cycle of the token in the business network

Using tokens effectively with the asset class and the economic and business models that govern the asset class

Ensuring the privacy-preserving characteristics of the token and the assets that it represents

Ensuring cross-ledger token resolution and token life-cycle and governance systems

Preserving value while transferring value to other value networks and secondary markets

These challenges can be addressed by deploying well-designed solutions that use blockchain constructs to embed trust and other adjacent technologies, such as tokenization platforms, registries, token vaults, and detokenization systems. We can rely on proven blockchain solution design practices to ensure the integrity, uniqueness, and value preservation of tokens in a network.

We are seeing the rise of new intermediaries when it comes to exchanges of the “value” that these tokens embody in a network with other value tokens. These intermediaries come in various forms, ranging from token exchanges, to decentralized exchanges, to network “asset” bridges, to token registries and repositories. These intermediaries solve a token fungibility issue, but they create the same set of cost and settlement challenges of current value-exchange systems.

Many different token types and classifications exist today. Although there is no standardized nomenclature, all these tokens have one thing in common: They represent and digitize value. Some of the token types include the following ones:

Pegged tokens

Stable coins

Tokenized securities

Security tokens

Utility tokens

Collateralized and decentralized tokens

Non-collateralized and decentralized tokens

Collateralized and centralized tokens

Initial coin offering (ICO)

Security token offering (STO)

Various Industry Definitions

Here are some definitions of tokenization from industry sources:

This is where stable coins come in. Stable coins are price-stable cryptocurrencies, meaning the market price of a stable coin is pegged to another stable asset, like the US dollar.2

Preston Byrne: A stable coin claims to be an asset that prices itself, rather than an asset that is priced by supply and demand.2

In their most simplistic form, stable coins are simply cryptocurrencies with stable prices measured in fiat currency.3

Types of stable coins: fiat collateralized, crypto collateralized, non-collateralized, collateralized decentralized, collateralized centralized, pegged, and so on.3

Tokenization is a method that converts rights to an asset into a digital token.4

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. There is great interest by financial intermediaries and technologists around the world in figuring out how to move real-world assets onto blockchains to gain the advantages of Bitcoin while keeping the characteristics of the asset.5

The varying industries (crypto and financial services and analyst communities) have varying points of view and definitions. This diversity makes it incredibility difficult to define concepts like technology or digital assets or traditional and conventional risk models.

Now that we have explored the token revolution and drawn a distinction between (crypto) assets and currency, let us explore the token valuation models and why they are important.

Token Valuation Models and the Instance Economy

Although an (crypto) asset or currency derives its value as a medium of exchange within a shared common belief system of a network (often confined to that network), tokens might have complex and fragmented valuation models. Many coins (started by ICOs and STOs) that aspire to morph into their own crypto assets, either as utility or security tokens, rely on the community to develop and recognize value. In contrast, many other tokens are only digital representations of the assets that they represent.

Assets today, such as stocks, bonds, securities, mortgages, and mortgage-backed securities, are difficult to transfer or subdivide physically, so buyers and sellers instead trade paper (or digital records) that represents these assets. The issue with paper (or digital records) and their accompanying complex legal agreements is that they are cumbersome and pose a challenge to transference and tracking, leading to opacity, fraud, opportunity, and transaction costs. One solution is to switch to a digital system that uses digital assets, such as tokenized assets on a blockchain network, but linked to an asset.

It might be prudent for us to classify these token valuations by either industry type (such as nonfinancial, supply chain, or financial services) or asset type (dematerialized, virtual, real asset, and others). Such a classification is necessary to establish a trail of governance with checks and balances and to represent some industry-recognized valuation systems. With this approach, it might seem as if all that we are achieving from tokenizing assets on blockchain networks is mimicking or creating a digital twin of current value networks, and that a fiat currency, although it addresses the duality of a transaction, can be replaced by a cryptocurrency (including digital fiat). In reality, the promise of blockchain-based business networks is not just about digitization and solving the inefficiencies of time and trust, but also about creating new business models and co-creation that capitalizes on the synergies of the network participants.

Thus, we see the introduction of the instance economy and secondary markets that are fueled by the instances of an asset. Tokenization of assets can lead to creation of a business model that fuels fractional ownership or the ability to own an instance of a large asset. Fractional ownership opens a market to participation from entities that were prevented from participating due to high capital requirements or the opacity of the value transfer systems. Furthermore, fractional ownership opens up a new range of asset classes and asset types, unlocking the economic value of capital that could not previously be accessed as investment opportunities.

We use the term instance economy because this type of economy fuels the tokenization of assets, which leads to the ownership of an instance of an asset class. This approach creates markets and secondary markets of value.

Although blockchain provides the technology constructs to facilitate exchange, ownership, and trust in the network, it is in the digitization of value elements that asset tokenization is truly essential. Tokenization is the process of converting the assets and rights or claims to an asset into a digital representation, or token, in a blockchain network. The distinction between cryptocurrency and tokenized assets is an important construct for understanding the exchange vehicles, valuation models, and fungibility across various value networks that are emerging. These networks pose challenges related to technical interoperability and equitable swaps. Tokenization of assets can lead to the creation of a business model that fuels fractional ownership or the ability to own an instance of a large asset. The promised asset tokenization within blockchain-based business networks depends on digitization and solving the inefficiencies of time and trust, and it creates new business models and co-creation from the synergies of the network participants.