- Growth Companies

- Characteristics of Growth Companies

- Valuation Issues

- The Dark Side of Valuation

- The Light Side of Valuation

- Conclusion

The Dark Side of Valuation

Given the many estimation issues we face when valuing growth companies, it is not surprising that the dark side of valuation manifests itself in many ways when analysts value these firms. In this section, we consider the ways in which valuations of growth firms can be skewed by unrealistic or unreasonable assumptions about the future, first in the context of discounted cash flow valuation and then in relative valuation.

Discounted Cash Flow Valuation

The estimation issues with valuing growth companies (outlined earlier in the chapter) generate heartburn among analysts, who then look for shortcuts, often devised from their valuation experiences with more mature firms, to get to a valuation.

Using Current Numbers as a Base

Most valuations start with a set of base year numbers, which usually come from the current financial statements. Analysts who follow this process with young companies will be building valuations on a shifting and unreliable foundation for several reasons. The first is that the numbers can be very small and not very meaningful for growth firms earlier in the life cycle. Many growth companies that have small revenues report operating losses, and extrapolating from either number can be dangerous. The second reason is that the hazy lines between operating and capital expenses at young companies can skew both earnings and reinvestment (capital expenditures) numbers. For instance, if much of the selling expenses are really for generating future growth, and they are treated as operating expenses, both income and capital expenditures will be understated. The third reason is that the volatility in the numbers can cause big changes from year to year in items like operating margin and return on capital that are fundamental inputs into any valuation. In general, mechanical or modeling-based valuation where you blindly forecast individual line items (like operating income, capital expenditures, and depreciation) for companies, based upon historical values for these items, will yield nonsensical valuations.

Scaling Issues

In the earlier sections, we pointed out our concerns about the sustainability of growth—how quickly the growth rates at growth firms will decrease as the firm becomes larger—because of the scaling effect and due to competition. Analysts who use historical growth rates as forecasts of future growth are susceptible to overvaluing their firms, because they are extrapolating growth rates posted by the firm when it was much smaller, to a much larger firm. In fact, this overoptimism about growth manifests itself in two ways: a higher growth rate for the growth period than the firm can sustain, and a much longer growth period than is likely. In fact, seeing growth companies valued with compounded growth rates of 25% or higher for ten years or longer is not uncommon.

Growth, Reinvestment, and Excess Returns

The focus on growth rates in revenues and earnings at growth firms often diverts attention from a variable that is just as critical in determining value. This variable is the reinvestment that the firm must make to deliver this growth. Chapter 2 argued that growth without excess returns (returns over and above the cost of equity and capital) adds no value to the firm. When valuing growth firms, paying heed to the excess returns that accompany a specified growth rate becomes critical.

In many discounted cash flow valuations, this lack of care in estimating (or even thinking about) excess returns manifests itself as inconsistencies between two key inputs into the valuation—the growth rate used and the reinvestment to deliver that growth rate. Given that the potential for efficiency growth (from improving returns on existing assets) is small at growth firms, it is extremely unlikely that a firm can deliver double-digit growth for extended periods without having to make substantial investments in the business. Any growth company valuation that combines high growth rates in revenues and operating income with little or no reinvestment will overvalue the firm.

In some cases, the error cuts in the opposite direction. Analysts assume low growth rates in conjunction with high reinvestment and come up with understated values. This is usually the case when analysts base future reinvestment numbers on current values for companies that are reinvesting significant amounts in the hopes of delivering high growth. Suppose analysts then follow the earlier dictum of lowering growth rates as the firm gets larger, but they leave the firm’s reinvestment policy unchanged at current levels. They are saddling the firm with the investment outflows of a high-growth firm, without the benefits of that high growth in earnings.

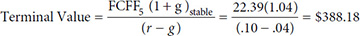

Note that the return on capital assumed for the high-growth phase is 25%. This is high but not unreasonable for a firm with investment opportunities. However, the return on capital built into the terminal value is 5%, likely to be below the cost of capital. Unless there is a clear reason to believe that the managers of this firm are hell-bent on destroying value in the long term, this is clearly an unrealistic assumption.

The bottom line is that estimating the cash flow for the terminal value computation by growing the prior year’s computation one extra year is always a dangerous practice, but it becomes doubly so with growth companies.

Growth and Risk

Just as growth and reinvestment are linked by our estimates of excess returns, risk and growth tend to move together. As we move through the forecast period, lowering the expected growth rate as the company gets larger and more stable, we should expect to see the risk of the business decrease. In too many growth company valuations, the cost of capital is estimated up front for the entire valuation and remains unchanged as the firm makes its transition from high growth to mature company. Holding all else equal, this will result in growth companies being undervalued. In effect, as we reduce growth, we are giving the company all the negatives of being a mature company without any of the positives.

Trusting Market-Based Risk Measures

Risk parameters in valuations, including betas and costs of equity, are often estimated using historical data. For instance, we estimate a firm’s beta by regressing the returns on the stock against return on a market index. With growth firms, this practice can lead to misleading estimates for two reasons. First, the stock has been listed only a short time, and the estimate that emerges from the data has a large error estimate. Second, the company’s characteristics have changed over the listing period, thus rendering the historical beta estimate useless as an estimate of the beta for the future.

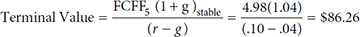

Consider the beta estimate for Shake Shack, using historical returns on the stock from October 2015 to October 2017, as shown in Figure 10.3.

Figure 10.3 Historical Beta Estimate for Shake Shack

The regression beta is 1.72, but the standard error on the estimate is 0.29. Furthermore, the beta reflects risk from 2015 through 2017, during which the firm was increasing the number of restaurants and growing rapidly. Using this beta to estimate the cost of equity for future years puts us at risk of using a regression estimate that has substantial standard error associated with it. It’s also possible that the number will not reflect the changes in the company’s fundamentals over time.

Shortcuts for Dealing with Convertibles and Voting Shares

In the section outlining the estimation issues associated with valuing growth companies, we noted that these firms are far more likely to issue convertible debt than straight debt when borrowing, and they have different classes of shares when it comes to voting rights. Analysts valuing growth companies look for simplifying assumptions when dealing with both phenomena. They tend to treat convertible debt as all debt until it gets converted, at which point it becomes all equity. At best, they assume that convertible bonds will get converted to shares, and they use the resulting total number (fully diluted) as the basis for computing value per share.

With voting and nonvoting shares, the practice is often either benign neglect, where the differences in voting rights are just overlooked or viewed as worthless, or the use of simple rules of thumb, where voting shares are assumed to command a fixed premium (such as 5%).

The Market Must Know Something I Don’t: The Market Price Magnet

When valuing publicly traded firms, it is difficult not to be aware of the stock’s market price and how far or close our estimate of value is from or to that number. In fact, there is a feedback mechanism, where a big difference between the price and the value leads an analyst to revisit the assumptions used in the valuation, with the inevitable narrowing of the difference. With growth companies, this feedback loop can take on a life of its own, partly because analysts are so uncertain about their future estimates. Consider an analyst who makes what she thinks are reasonable assumptions about growth, cash flows, and risk and arrives at a value that is one quarter of the market price. She will be tempted to go back and increase growth rates and returns, and lower the discount rate, to arrive at a value closer to the stock price. In fact, the common practice of using multiples to get terminal values is rooted in the desire to get value closer to price, because feeding in a high multiple into the terminal value calculation will improve the chances of the two numbers converging.

Relative Valuation

At the risk of overgeneralizing, analysts who go down the relative valuation path are looking for even more simplistic ways of dealing with growth than analysts who wrestle with discounted cash flow valuations. Not surprisingly, the errors that we see in the relative valuations of growth companies reflect the errors of these time-saving assumptions.

Sector-Based Comparables

Much of the relative valuation in practice is built around building comparable firms from other firms in the sector. Thus, software firms are compared to other software firms and energy firms to other energy firms. Adopting this practice when valuing growth companies can be dangerous, especially in sectors with diverse growth characteristics. Take the software business as an example. Although this segment has high-growth firms, they coexist with firms like Microsoft that are more mature. Using industry average multiples to value individual software firms will lead to poor estimates of values.

Sector-Specific Multiples

One of the problems we face with valuing some growth firms using multiples is the absence of an operating variable of any substance that can be used to scale value. Many growth firms, early in the growth cycle, have negative net income, operating income, and EBITDA, making it impossible to apply any earnings-based multiple. Rather than fall back on revenues, the only operating variable that cannot be negative, some analysts use multiples of operating measures that are specific to the sector. In the late 1990s, with nascent Internet companies, analysts estimated value as a multiple of website visitors. With cable TV and telecommunications companies, value was computed as a multiple of the company’s subscribers. With social media companies like Snap, enterprise value is scaled to the number of users. In each case, the comparisons were made within the sectors, with low values per visitor/subscriber/user indicative of cheap companies.

While the push toward sector-specific multiples can be justified by arguing that the company’s operating variables fall short, it does expose you to some significant valuation problems. The first is that few people have a sense of what is high, low, or reasonable for a sector-specific multiple. Put another way, while we might hold back from paying 100 times revenues for a company (because we know that this is a high value), we might not hold back from paying $3,000 per subscriber. This is partly because we have little or no sense of what a reasonable value per subscriber is. The second problem is that assessing what fundamentals, if any, we should be controlling for becomes more difficult with sector-specific multiples. Thus, while we know the variables that cause PE ratios to vary across companies (see Chapter 4), we have little sense of the key factors that cause the value per subscriber to vary across firms.

Unrealistic Growth/Value Relationships

Most analysts valuing growth companies are aware that growth affects multiples. They know that higher-growth companies should trade at higher multiples of earnings, revenues, or any other operating variable than lower-growth companies. At the same time, they want to stick with the simplicity of multiples and not deal with the complexity of analyzing the effect of changing growth rates on value. This manifests itself in valuation in two ways:

Pure Storytelling: Rather than deal with differences in growth rates quantitatively, some analysts argue for the use of higher multiples for higher-growth companies, without being explicit about the relationship between growth and value, with a “growth story.” Consequently, they argue that Chinese consumer products companies should trade at higher multiples of earnings than European companies because China has more potential growth. But they are fuzzy on how much more growth exists and what premium it justifies.

Modified multiple: A compromise that takes into account growth while preserving simplicity would be to incorporate growth into the multiple. But this requires us to make unreasonable assumptions about the relationship between growth and value. Consider, for instance, the price earnings ratio. We know that higher-growth companies trade at higher PE ratios than lower-growth companies and that investing in the lowest PE stocks will bias you toward lower-growth companies. It was to counter this bias that analysts developed the PEG ratio—the ratio of PE to expected growth:

PEG = PE /Expected Growth in Earnings per Share

For example, a firm with a PE ratio of 20 and an expected growth rate in earnings per share of 10% would have a PEG ratio of 2. Companies that trade at low PEG ratios represent bargains, because you get growth at a lower price.

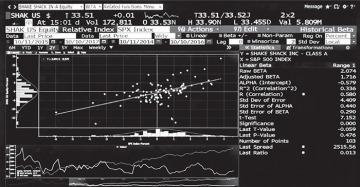

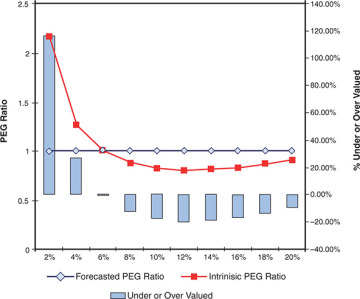

All shortcuts in valuation have a price. The PEG ratio comes with a hefty price tag. First, it ignores the effects of risk. If two firms have the same expected growth rate in earnings, the higher-risk firm should trade at a lower PE (and a lower PEG) ratio. Second, it assumes that PE increases proportionately with growth; as growth doubles, the PE ratio doubles. In reality, though, value increases less than proportionately with growth. Figure 10.4 shows the intrinsic PEG ratio for a hypothetical firm at different expected growth rates. It shows how undervalued (or overvalued) the firm will look using the conventional PEG ratio. The intrinsic PEG ratio reflects the complicated relationship between PE and growth, whereas the conventional approach assumes that it remains unchanged (at 1) as growth changes.

Figure 10.4 Intrinsic versus Conventional PEG Ratio

Using the conventional PEG ratio, with its flawed assumptions of growth and PE, leads us to conclude that the firms with high growth are undervalued and that firms with low growth rates are over valued, even when they are all fairly valued.

Forward Multiples and Changing Fundamentals

When confronted with current year numbers for revenues and earnings that are either too small or negative, some analysts use forecast values for revenues and earnings to compute forward multiples for comparison. This practice makes sense, and we recommended it in the preceding chapter on young growth companies. However, remember that the multiple we attach to revenues or earnings in a future year should reflect the characteristics of the company in that year rather than its current characteristics. Many analysts use multiples that are based on current growth characteristics to arrive at forward values and thus double-count growth. Consider, for instance, a firm that has revenues of $50 million today and a forecast revenue growth of 50% a year for the next five years; the revenues in year 5 will be $380 million. A valuation that applies a high multiple to the revenues in year 5, with the high multiple justified by the high growth rate of 50%, in effect double-counts growth. A more reasonable valuation would use a multiple more in line with growth after year 5 (likely to be much lower than 50%).