- Introduction

- 1.1 Long Call

- 1.2 Short (Naked) Call

- 1.3 Long Put

- 1.4 Short (Naked) Put

1.1 Long Call

Proficiency |

Direction |

Volatility |

Asset Legs |

Max Risk |

Max Reward |

Strategy Type |

|

|

N/A |

|

|

|

|

Novice |

Bullish |

|

Long Call |

Capped |

Uncapped |

Capital Gain |

1.1.1 Description

Buying a call is the most basic of all option strategies. For many people, it constitutes their first options trade after gaining experience buying and selling stocks.

Calls are easy to understand. A call is an option to buy, so it stands to reason that when you buy a call, you’re hoping that the underlying share price will rise.

ITM |

In the Money |

stock > call strike price |

ATM |

At the Money |

stock = call strike price |

OTM |

Out of the Money |

stock < call strike price |

Steps to Trading a Long Call

Buy the call option.

- Remember that for option contracts in the U.S., one contract is for 100 shares. So when you see a price of 1.00 for a call, you will have to pay $100 for one contract.

- For S&P Futures options, one contract is exercisable into one futures contract. If the option price is 1.00, you will pay $250 for one futures contract upon exercise.

Steps In

- Try to ensure that the stock is trending upward, and is above a clearly identifiable area of support.

Steps Out

- Manage your position according to the rules defined in your trading plan.

- Sell your long options before the final month before expiration if you want to avoid the effects of time decay.

- If the stock falls below your stop loss, then exit by selling the calls.

1.1.2 Context

Outlook

- With a long call, your outlook is bullish. You expect a rise in the underlying asset price.

Rationale

- To make a better return than if you had simply bought the stock itself. Do ensure that you give yourself enough time to be right; this means you should go at least six months out, if not one- or two-year LEAPs. If you think these are expensive, then simply divide the price by the number of months left to expiration and then compare that to shorter-term option prices. You will see that LEAPs and longer-term options are far better value on a per-month basis, and they give you more time to be right, thus improving your chances of success. Another method is to buy only shorter-term deep ITM options.

Net Position

- This is a net debit transaction because you pay for the call option.

- Your maximum risk is capped to the price you pay for the call.

- Your maximum reward is uncapped.

Effect of Time Decay

- Time decay works against your bought option, so give yourself plenty of time to be right.

- Don’t be fooled by the false economy that shorter options are cheaper. Compare a one-month option to a 12-month option and divide the longer option price by 12. You will see that you are paying far less per month for the 12-month option.

Appropriate Time Period to Trade

- At least three months, preferably longer, depending on the particular circumstances.

Selecting the Stock

- Ideally, look for stocks where the OVI is persistently positive for at least the last few days.

- Choose from stocks with adequate liquidity, preferably over 500,000 Average Daily Volume (ADV).

- The stock should be trending upward, and be above a clearly identifiable area of support.

Selecting the Options

- Choose options with adequate liquidity; open interest should be at least 100, preferably 500.

- Strike—Look for either the ATM or ITM (lower) strike below the current stock.

- Expiration—Give yourself enough time to be right; remember that time decay accelerates exponentially in the last month before expiration, so give yourself a minimum of three months to be right, knowing you’ll never hold into the last month. That gives you at least two months before you’ll need to sell. Longer would be better, though.

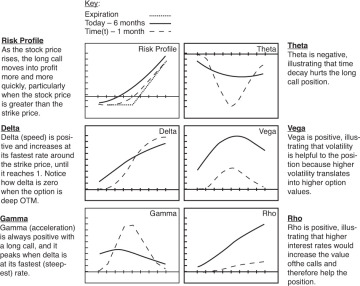

1.1.3 Risk Profile

• Maximum Risk |

[Call premium] |

• Maximum Reward |

[Uncapped] |

• Breakeven |

[Call strike + call premium] |

1.1.4 Greeks

1.1.5 Advantages and Disadvantages

Advantages

- Cheaper than buying the stock outright.

- Far greater leverage than simply owning the stock.

- Uncapped profit potential with capped risk.

Disadvantages

- Potential 100% loss if the strike price, expiration dates, and stock are badly chosen.

- High leverage can be dangerous if the stock price moves against you.

1.1.6 Exiting the Trade

Exiting the Position

- Sell the calls you bought.

Mitigating a Loss

- Use the underlying asset or stock to determine where your stop loss should be placed.

1.1.7 Margin Collateral

- Being a long net debit strategy, there is no margin requirement per se because the risk of the trade is limited to the initial cost.

1.1.8 Example

- ABCD is trading at $28.88 on February 19, 2015.

- Buy the January 2016 27.50 strike call for 4.38.

You Pay |

Call premium 4.38 |

Maximum Risk |

Call premium 4.38 Maximum risk is 100% of your total cost here |

Maximum Reward |

Unlimited as the stock price rises |

Breakeven |

Strike price + call premium 27.50 + 4.38 = 31.88 |