Beware the Keynesian Mirage

- Condition: Low Policy Rates Set by the World's Central Banks

- Condition: Reduced Use of Financial Leverage

- Condition: An Altered Global Economic Landscape

- Sharing the Burden

- Emphasize Investment, Not Consumption

- Government Spending Must Be Redirected as Well as Cut

Those who refer to historical examples where fiscal stimulus worked and where despite increased indebtedness there was no corresponding increase in market interest rates do so with contempt toward the financial crisis and its profound message about overleveraged societies and the extended period by which the deleveraging process tends to last and leave destruction in its wake. Reinhart and Rogoff,1 for example, suggest that the deleveraging process that follows a financial crisis tends to last about ten years. McKinsey & Company find similar results, as shown in the summary in Table 1-1:2

TABLE 1-1 Duration and Extent of Deleveraging Following a Financial Crisis

|

Archetype |

Number of Episodes |

Duration1 (Year)s |

Extent of Deleveraging (Debt/GDP Change) |

||

|

% |

pp |

||||

|

“Belt-tightening” |

16 |

6–7 |

-29 |

-40 |

21 vs. 2 |

|

Median |

5 |

-24 |

-34 |

21 vs. 3 |

|

|

“High inflation” |

8 |

7 |

-53 |

-93 |

50 vs. 46 |

|

Median |

8 |

-62 |

-34 |

36 vs. 27 |

|

|

“Massive default” |

7 |

6 |

-36 |

-46 |

41 vs. 10 |

|

Median |

8 |

-55 |

-72 |

28 vs. 9 |

|

|

“Growing out of debt” |

1 |

6 |

-25 |

-44 |

0 vs. 12 |

|

Total2 |

32 |

6–7 |

-37 |

-54pp |

32 vs. 14 |

|

Note: Averages remain similar when including episodes of deleveraging not induced by financial crisis. |

|||||

Source: IMF, McKinsey Global Institute

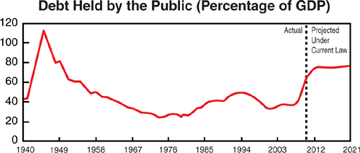

The source of this contempt almost certainly is rooted in the behavior of the interest rate markets amid the buildup of government debt over the past three decades and especially in the aftermath of the financial crisis, which has been marked by a plunge in market interest rates despite a massive increase in sovereign debt outstanding relative to the increase in economic activity in sovereign nations. In other words, although debt-to-GDP ratios for nations in the developed world have increased, there has been no corresponding increase in market interest rates. In fact, market interest rates have fallen for 30 years, as shown in Figure 1-1.

Figure 1-1 The “Duration Tailwind”

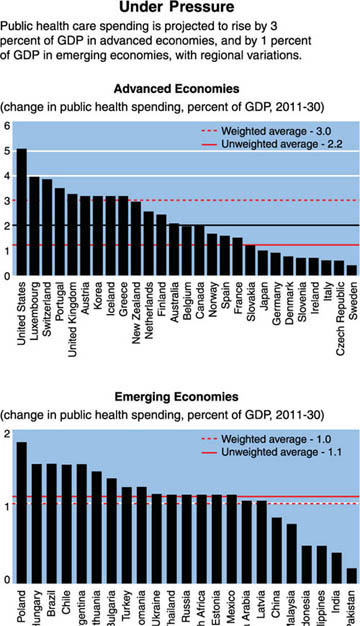

Consider Figure 1-2, which reflects the deterioration in the U.S. fiscal situation, as illustrated by a sharp increase in its debt-to-GDP ratios.

Figure 1-2 Sovereign debts are becoming mountainous.

Source: Congressional Budget Office; http://cbo.gov/ftpdocs/120xx/doc12039/01-26_FY2011Outlook.pdf

When looking at Figure 1-2, it is important to keep in mind that in addition to the historical perspective, there is widespread expectation for further deterioration in the years to come, owing in no small part to expected increases in entitlement spending, such as health care and retirement benefits, particularly in developed nations (see Figure 1-3). This is especially true in the United States where in 2011 the so-called Baby Boomers (those born in the years 1946 through 1964) began turning 65.3 I discuss the very important implications of this and the powerful concept known as gerontocracy in Chapter 6, “Age Warfare: Gerontocracy.” Investors are familiar with the implications and as such their expectation for further deterioration in public sector balance sheets will be a major driver of cash flows for many years to come, which is to say that many investment decisions will be made on the belief that the developed world will be saddled by debt and be a relatively risky place to invest.

Figure 1-3 Projected global health care spending—the U.S. tops them all.

Source: http://www.imf.org/external/pubs/ft/fandd/2011/03/Clements.htm

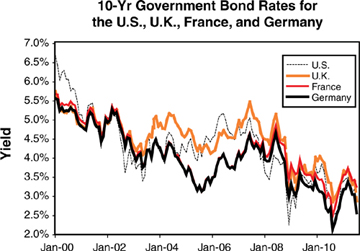

Figure 1-4 shows more closely the behavior of interest rates over the past decade in the United States, the United Kingdom, France, and Germany, as reflected by the ten-year yield for government securities in each of the respective countries.

Figure 1-4 Don’t be fooled by these falling rates.

Keynesians would say that the combined message from these charts is that they illustrate the very small extent to which bond investors worry about the buildup of sovereign debt and the deterioration of public sector balance sheets. After all, Keynesians will tell you, interest rates on sovereign debt decreased substantially during a period when public sector balance sheets deteriorated substantially. Keynesians also stress that this is how it has been for decades, with interest rates tending to fall during periods when public deficits increased.

Keynesians in fact believe that recessions are a good time to increase government borrowing. They seize upon the idea that during periods of economic weakness it is much easier for the public sector to issue debt and to do so at interest rates lower than those that prevailed prior to the weakness because during such times private demands for credit tend to be weak, resulting in a redirection of investment flows toward government debt. This has certainly been true historically: During periods of economic weakness, the creation of bank loans, the origination of mortgage credit, and issuance of company bonds slows or declines, and during such times money flows to government bonds because it’s the only game in town—money must find a home.

Another source of contempt relates to the way investors are using the credit histories of developed nations to rationalize assigning low levels of market interest rates to sovereign debt in the developed world. Investors believe that because these nations have favorable long-standing credit histories that they remain “risk free.” Take the United Kingdom, for example. It has not defaulted on its debts since the Stop of the Exchequer in 1672.4 So why should anyone question adding on still-more debt to try to bring down unemployment? It is rational, in fact, to believe that nearly 350 years of pristine credit is a formidable defense for continuing Keynesian economics and to believe there is no such thing as a Keynesian Endpoint where nations reach their limits for gainful borrowing.

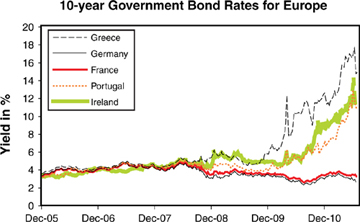

It is a fallacy to believe that the ability of nations to issue ever-increasing amounts of new debt at the Keynesian Endpoint will be the same as it was in the past, and it is lunacy to believe that in the immediate aftermath of the financial crisis that bond investors will turn a blind eye to a continuation of fiscal profligacy. Investors have evolved and now have distaste for fiscal irresponsibility, as has the public, especially after the disappointing results of the massive fiscal stimulus deployed in 2009 by many countries in the developed, in particular in the United States, to counteract the financial crisis. Evidence of evolving views toward government indebtedness is illustrated by the behavior of bond markets toward nations at the lower end of the wrung in terms of their fiscal situations, particularly toward Europe’s periphery, especially Portugal, Ireland, and Greece, and to a lesser extent Spain (commonly referred to by the acronym, PIGS), which has thus far been spared the worst outcome by successful attempts by Europe to ring-fence its problems to Portugal, Ireland, and Greece. Europe has done this by building many “bridges to nowhere” that have bought Spain as well as Italy time for Europe’s banks to derisk their portfolios and rebuild their capital before any defaults occur.

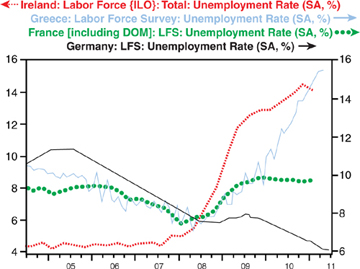

Figure 1-5 shows the behavior of government bond yields for PIGS relative to German and French bond yields, which have been suppressed by capital flows both globally and from money previously invested in Europe’s periphery that has in recent times been directed toward “core” Europe – Germany and France, whose debt problems are more manageable and where economic growth has been substantially better than for PIGS, as shown in Figure 1-6, which shows the unemployment rate for nations in Europe.

Figure 1-5 Oh, what debt can do to rates!

Figure 1-6 Oh, what debt can do to an economy!

Rather than consider the potential for contamination and contagion from Europe’s periphery to its core, Keynesians prefer the notion that past is prologue and believe that global bond investors will continue to be attracted to debt markets in nations with strong credit histories despite the significant deterioration in their underlying credit fundamentals. This is unwise thinking. The move toward joining the least worst in the league of heavily indebted nations and the clan that in the immediate aftermath of the financial crisis has seemingly stabilized is merely a pit stop—the move by investors away from the core is likely to be nonlinear, which is to say that it will most likely occur gradually, as a process, not an event, when investors begin to believe the periphery is rotting the core. And deterioration in core Europe has the potential to occur faster than investors expect because more than ever the deterioration in underlying credit fundamentals put developed nations at a tipping point and make them vulnerable to a breakdown in confidence.

Investors tend in general to underestimate the risks of a sudden stop, and they tend not to position themselves for tail events—the big, unexpected events that make news only after they have happened, not while they are developing. These events tend to occur much more often than many expect when they consider normal distribution curves, as illustrated by Table 1-2. In other words, tail risks in the investment world have proven to be far larger than models would predict. Investors therefore need to think and position their portfolios in terms of tail risks and be leery of normal distribution curves. At the Keynesian Endpoint, this means investors should position for the possibility of sovereign defaults and their vast ripple effects in the global economic and financial system.

TABLE 1-2 Big Things Happen More Often Than Most People Expect.

|

Daily Change in DJIA 1916 – 2003 (21,924 Trading Days) |

|||

|

Daily Change (+/-) |

Normal Distribution Approximation |

Actual |

Ratio of Actual to Normal |

|

> 3.4% |

58 days |

1001 days |

17x |

|

> 4.5% |

6 days |

366 days |

61x |

|

> 7% |

1 in 300,000 years |

48 days |

Very large |

Source: PIMCO, Benoit Mandelbrôt: The (Mis)behavior of Markets, Basic Books, March 2006

Investors in developed markets must also stay attentive to attempts by indebted nations to repress them for the sake of liquidating public debts. These nations will attempt to suppress market interest rates to levels that are close to or below the rate of inflation, hoping that their economies will grow at a rate that exceeds the interest rates they pay on their debts, a combination that enables nations to reduce their debt-to-GDP ratios. In these cases, investors will experience a loss of purchasing power on two fronts. First, they will be put behind the eight ball by lagging inflation and thereby losing domestic purchasing power. Second, low or negative real interest rates will reduce the attractiveness of their home currency, which is apt to depreciate and thereby result in a loss of purchasing power internationally. Investors must recognize also that policymakers intend to carry out their repression in a way that makes them akin to frogs that stay in slowly boiling pots only to die. Investors instead should be like frogs that are placed in pots already boiling and jump out.

A paradox to some, the Keynesian Endpoint means that Austrian economics, which is predicated on the idea of a laissez-faire style of governmental involvement, will regain popularity and will therefore become more influential in shaping policymaking in the time ahead. Mind you, I do not mean to say that the Austrian style of economics that dominated the later part of the twentieth century will return—long live Reaganism and Thatcherism. Instead, Keynesians will be forced to let Austrian economists shape the heavy hand of government involvement and control that has dominated the post-crisis policy-making landscape. For example, taxpayers will demand that tax receipts be directed more efficiently than they have in the past, such that every unit of currency taken in is spent in ways that they believe are most likely to benefit society. One example is the doling out of benefits to public sector unions, which continue to receive health and pension benefits that far exceed those received by the private sector.

This means that government will attempt to stimulate economic activity not by increasing its spending, but by changing the composition of its spending. Policymakers will also seek changes in taxation and regulations that encourage businesses and households to spend and invest. The goal from here on will be to ignite multiplier effects that debt spending can no longer ignite. A major challenge in this regard will be the ability of developed nations to muster sufficient political support for changing their mix of government spending at a time when their populations are aging. These nations are predisposed to spending more on health care and retirement benefits, which will make it difficult to direct money away from these areas toward areas that tend to promote strong, sustainable economic growth, including infrastructure, research and development, and education.

The integration of the Keynesian and Austrian schools of thinking will be necessary because Keynesians have no more balance sheets to spend from, and followers of the Austrian school of thinking are not yet in control of balance sheets (nor do they want to be in control). This transformation could take quite a bit of time, but not all that long because the populace will provide a mandate for change, the same as it did in the early 1980s and then again in the early 1990s when supply-side economics was tweaked. How will this happen? High levels of unemployment or general economic discontent always lead citizens to rise up, either in arms or with their votes. Economic stress has a way of crystallizing the sorts of policies that are both the least and most desirable for a given time. The result of the November 2010 U.S. election is an example of this. Voters picked candidates that seek reduced government activism, rebuking Keynesian economics. The November 2012 general election will be the next big opportunity for voters to express their views on Keynesian economics, the dominant policy tool at the onset of the financial crisis. Indications are that voters will reject the philosophy and oust incumbents that have supported it because in the U.S. as well as throughout the world, the fiscal authorities have failed to reduce unemployment to desirable levels in spite of massive fiscal stimulus efforts.

More than at any time since the 1980s, citizens throughout the voting world will vote to eject “leaders” who favor a continuation of fiscal policies that yield little in terms of economic growth and in fact create conditions that could actually erode economic activity because of both an inefficient use of public money and a decrease in confidence tied to concerns about the long-term risks and implications of government activism. Confidence in the ability of policymakers to adopt policies that bear fruit has diminished in today’s world for many reasons, not the least of which is the fear that taxpayers have about the future confiscation of their income to pay for the run-up in government debts. Moreover, the loss of the Keynesian security blanket—the now apparent inability of government to increase employment by waving their magic debt wand—has shaken the foundation by which investors and consumers take risks, and this uncertainty is causing them to disengage. Policymakers must find new ways to boost confidence, and these days many believe the best way is for them to get out of the way.

At the Keynesian Endpoint, the ability of nations to pursue expansionary fiscal policies is curtailed, leaving nations with few options other than to run expansionary monetary policies that lift asset prices and power economic growth in the short-run. Many long-run options exist; in particular a redirection of fiscal spending toward investments that address the structural challenges that nations face rather than the cyclical ones. Unfortunately, it’s a long slog, and it will therefore be some time before the deeply indebted see a return to “old normal” levels of economic growth. Nations seen as the worst offenders in the debt crisis will be forced to hasten the repair of their balance sheets, and they will have to reduce their spending, crimping their economic growth rates—materially in some cases, especially relative to nations in the emerging markets, many of which are now creditor nations.

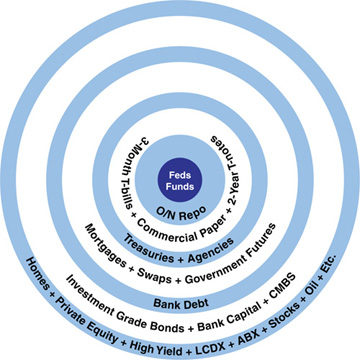

With the ability of the fiscal authority curtailed, the monetary authority—the central bank—is left to do the heavy lifting. Mind you, there are limits to what central banks in the developed world can do because they risk losing hard-won inflation-fighting credibility they took decades to build. These include the Federal Reserve, the Bank of England, the Bank of Japan, and the European Central Bank (largely through the German Bundesbank, upon which the ECB’s credibility was established). Neither of these banks is likely to succumb to their respective fiscal authorities and monetize profligate fiscal behavior. Instead, they will pursue only the most responsible irresponsible expansionary policies, which is to say they will use policy tools that in normal times would be deemed irresponsible but today are necessary to achieve a set of outcomes different from what is deemed normal for the central banker. In particular, the central banks of highly indebted nations (primarily those of developed nations) will implement policies designed to prevent deflation and restore their respective inflation rates to levels that reduce the risk of deflation, generally to around 2 percent. One of these responsible irresponsible policies is the attempt to reflate asset prices. This is accomplished by establishing a low policy rate and by indicating it will be kept there for an “extended extended” period that creates a virtual house of pain in shorter-term fixed-income assets, compelling investors to move out the risk spectrum, as shown in Figure 1-7. Responsible central banks will recognize their limits, preventing any meaningful acceleration in the inflation prices of goods and services and in the reflation of the prices of financial assets, carrying important investment implications.

Figure 1-7 Low interest rates compel investors to move to the perimeter of the risk spectrum.

Source: PIMCO

The investment implications in conditions such as these where the fiscal authority is rendered powerless in the short-run and the monetary authority is constrained by the defense of its hard-won credibility are many, and they mainly relate to the likelihood of slower than historical rates of economic growth, low to negative real interest rates for shorter-term fixed-income securities, and an ever-present risk of tail events, which will persist until debt levels are reduced relative to incomes. These elements in particular should guide portfolio positioning.

Following are a few of the many conditions and investment implications of the Keynesian Endpoint, which are covered in greater detail in Chapter 9, “The Investment Implications of the Keynesian Endpoint.”

Condition: Low Policy Rates Set by the World’s Central Banks

To boost asset prices, liquidate government debts, reduce the debt burdens of the private sector, and stave off deflationary pressures that result from shortfalls in aggregate demand relative to supply, central banks will keep short-term interest rates low for the foreseeable future.

Investment Implications

Steep Yield Curves

Low policy rates engender steep yield curves in two ways in particular. First, they anchor rates at the short-end of the yield curve, pinning them lower. Second, low interest rates and accommodative monetary policies more generally enliven expectations for a strengthening of economic activity, boosting longer-term interest rates, where expectations for future inflationary pressures and eventual increases in short-term interest rates reside. Central bank rate cuts are a clarion call for investors to engage in strategies designed to benefit from a steep yield curve for many months forward because monetary policy regimes tend to be long lasting. One strategy is to speculate against the possibility of future interest rate hikes, which many investors implement by betting against any central bank rate hikes that might be embedded in Eurodollar or federal funds futures contracts. In Europe, investors bet against increases in EURIBOR and EONIA, two key short-term interest rates in Europe. Investors can also invest to benefit from the positive carry and “roll down” that can be earned by investing in short maturities. For example, a U.S. 2-year Treasury yielding 0.80 percent will “roll down” the yield curve such that in a year’s time, when it becomes a 1-year Treasury, its yield will reflect the yield on 1-year maturities, say at 0.40 percent, picking up more for a year’s worth of “roll down” than is possible, say, from owing a 20-year maturity that becomes a 19-year maturity in a year’s time. (If a 40-basis-point yield difference existed for all securities on a yield curve spanning 20 years, the 20-year maturity would yield over 8 percent!)

Lower Rates Across the Yield Curve

Low short-term interest rates anchor interest rates across the entire yield curve, and in an environment such as today’s where vast amounts of excess capacity are keeping a lid on wage inflation, inflation and hence interest rates are likely to stay under downward pressure for some time to come. The strategy therefore is to maintain a higher level of duration, or interest rate sensitivity in fixed-income portfolios than normal, at least until evidence begins to mount that the world’s central banks are becoming successful in reflating asset prices. In 2011, signs emerged in this regard, and a pickup in inflation is reducing the attractiveness of duration—credit is more likely to be the better source of value in a case where economic growth is sustained and inflation pressures are building.

In the early stages of monetary easing, “soft” duration is preferred over “hard” duration, which is to say it is better to increase the duration of a portfolio by increasing the amount of exposure to short-term maturities, such as Eurodollar contracts, or 2-year notes, which are likely to outperform long-term maturities on a duration-weighted basis. (An investor must purchase many more 2-year notes than, say, 10-year notes, in order to equate the interest rate sensitivity of 2-year notes to 10-year notes.) Eventually, investors should shift to “hard” duration and choose longer-term instruments when it appears likely that the Federal Reserve is set to begin its sequence of policy steps that will lead to a hike in short-term rates. When this happens the yield curve will flatten, and long-term maturities will outperform shorter maturities.

Low Interest Rate Volatility

When policy rates are kept steady for an extended period, interest rate volatility tends to be lower than it is during periods when the central bank is either raising or lowering rates. The reason is because of the anchoring principle mentioned earlier. It is notable, for example, that at no time in the past 40 years has the 10-year Treasury note yielded more than four percentage points more than the federal funds rate—now that’s an anchor! When a central bank is expected to hold its short-term rate steady, an investment strategy that has worked well historically is to bet against volatility, through yield enhancement strategies such as selling option premiums, either by selling listed options or over-the-counter options, in the swaptions market, the options market for the giant interest rate swaps market. It’s not a strategy suitable for all investors but one often deployed by institutional investors.

Tighter Credit Spreads

When interest rates are kept low for an extended period, investors tend to become increasingly compelled to seek out higher returns, pushing them out the risk spectrum. In doing so, widespread purchases of so-called “spread” products, which include corporate bonds, asset-backed securities, mortgage-backed securities, and emerging markets bonds, cause these instruments to tend to perform well relative to assets deemed less risky, in particular government securities such as U.S. Treasuries. The strategy in this case therefore is to purchase spread products. Importantly, however, today’s risky credit environment means investors need proceed cautiously. This means staying high in the capital structure—choosing bonds over equities and choosing bonds that are more senior in terms of rank in the event of a company’s liquidation. It also means investing in bonds of high quality and of those whose cash flows will be less vulnerable in an economic recovery. Moreover, it sometimes means choosing companies with hard assets to sell because in the aftermath of a financial crisis, the recovery rates for bondholders of any liquidation is likely to be lower than in other times. Bonds that tend to make sense under these conditions include pipelines, utilities, and those of companies in energy and energy-related industries, as well as in the metals and mining arena. Each of these industries will retain some degree of pricing power, and their cash flows will be less vulnerable to cyclical forces than industries such as housing, gaming, lodging, retail, and those related to consumer discretionary spending.